In the era of digital transformation, businesses are navigating a complex and data-driven landscape, where ensuring regulatory compliance presents multifaceted challenges across different industries. Whether in finance, healthcare, or any other sector, adhering to intricate rules and regulations is now a must, not a choice.

Especially, the financial solutions sector, which deals extensively with monetary transactions, faces heightened concerns about transactions falling into the wrong hands. In such scenarios, adhering to regulatory compliances becomes imperative for conducting business securely and safely. Non-compliance with regulations can spell disaster for financial institutions, resulting in severe repercussions. This may encompass legal penalties, substantial fines, and a tarnished reputation due to failure to meet regulatory standards set by governing bodies.

The financial industry encountered hefty losses of around $5.02 billion in 2021, attributed to regulatory penalties for non-compliance with anti-money laundering (AML) and data privacy regulations. Subsequently, in 2022, financial institutions faced staggering fines of nearly $8.1 billion due to their inability to prevent money laundering effectively.

In this blog, we will look at what is the role of AI and ML in ensuring regulatory compliance in financial solutions /digital lending.

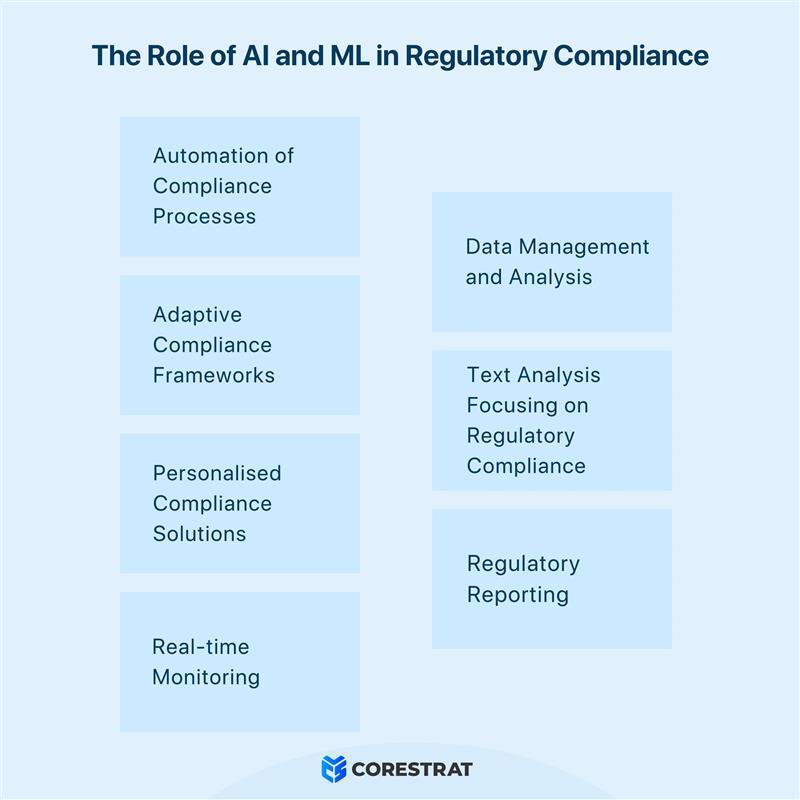

The Role of AI and ML in Regulatory Compliance

As regulations governing this sector regularly evolve and adapt to changing scenarios, manually keeping up with these updates can be both tiresome and error-prone. This is where AI and ML play their part in helping financial institutions streamline and automate labour-intensive compliance processes and also offer a proactive, data-driven approach to identify and mitigate compliance risks in real time.

Automation of Compliance Processes

One of the most significant advantages of AI and ML in regulatory compliance is process automation. Routine compliance tasks, such as document verification, transaction monitoring, and reporting, can be automated, reducing human errors and enabling personnel to focus on higher-value tasks.

ML-driven automation streamlines routine compliance tasks, diminishing the necessity for manual intervention. This enhances operational efficiency, enabling human resources to concentrate on strategic decision-making and tasks that require more human attention.

Adaptive Compliance Frameworks

Machine learning models offer financial institutions a transformative advantage in regulatory compliance. Their adaptability and continuous learning capabilities enable them to evolve alongside changing regulations, ensuring institutions remain compliant. These models learn from new data, swiftly incorporating regulatory changes into their compliance strategies. They predict potential risks, customise compliance approaches, and facilitate faster responses to emerging challenges.

By continuously refining their understanding of compliance patterns, they empower institutions to make informed decisions, mitigate risks proactively, and optimise compliance frameworks, especially compliance solutions in digital lending. This adaptability not only ensures adherence to evolving regulations but also enhances efficiency, scalability, and the ability to tailor compliance strategies to meet specific organisational needs.

Real-time monitoring

Real-time monitoring in AI and ML-driven compliance management is about constant, immediate analysis of data and activities as they happen. These systems continuously watch transactions and behaviours, quickly spotting any irregularities or potential compliance breaches. These anomalies could range from unusual transactional behaviour to atypical customer activities. When such deviations are detected, the ML-powered systems trigger real-time alerts. These alerts serve as a crucial mechanism for an immediate response, enabling swift action to mitigate any potential compliance risks. These systems learn from ongoing data, adapting to improve accuracy in detecting future compliance issues.

This rapid response significantly reduces the impact of any identified issues, helping institutions to take corrective measures promptly. By addressing these concerns swiftly, financial organisations can potentially minimise the severity of compliance breaches, thereby mitigating associated risks of regulatory penalties or sanctions that might arise from delayed or inadequate responses to such incidents.

Data Management and Analysis

AI and ML excel in managing vast amounts of both structured and unstructured data for financial institutions, which might be a difficult task when done manually. They process and interpret this data from diverse sources, identifying patterns, anomalies, and potential compliance risks. These technologies analyse transaction records, customer data, and unstructured sources like social media or emails.

By recognising both expected and unexpected patterns, they flag anomalies that could signify compliance issues. Their predictive capabilities help foresee potential risks, aiding proactive risk management. Ultimately, AI and ML’s efficiency in handling diverse data sources allows institutions to gain comprehensive insights, enabling precise compliance measures and proactive risk mitigation.

Personalised Compliance Solutions

Machine learning analyses historical data to understand the unique compliance challenges of financial institutions. AI identifies potential compliance risks specific to each institution’s operations by recognising patterns and trends within this data. Through analysis, machine learning provides nuanced insights into potential compliance risks. It pinpoints areas where the institution might face regulatory challenges, allowing for proactive risk mitigation strategies and decision making. Based on these insights, machine learning tailors compliance strategies to suit the specific needs of each institution. This customisation ensures that compliance measures align precisely with the identified risks and operational nuances of the organisation.

Text analysis focusing on regulatory compliance

AI and ML-powered Natural Language Processing (NLP) tools are vital for the finance industry’s compliance challenges. It navigates the complexities of regulatory documents by reading, interpreting, and summarising critical updates. NLP algorithms decipher legal jargon, extract key information, and distil complex texts into understandable insights. By automating this process, NLP ensures rapid access to the latest regulatory changes, empowering compliance teams to stay updated and align operations with the law efficiently. This capability aids in swift compliance adherence and mitigates regulatory risks within organisations.

Regulatory Reporting

AI streamlines regulatory reporting by organising vast amounts of data, automating reporting tasks, ensuring accuracy, reducing human error, and guaranteeing compliance with specific reporting standards set by regulatory authorities. Its ability to handle data at scale and automate reporting processes significantly enhances the efficiency and accuracy of compliance reporting within financial institutions.

Conclusion

AI and machine learning have emerged as indispensable tools in ensuring regulatory compliance within financial solutions and digital lending. Their ability to streamline processes, enhance risk management, and adapt to evolving regulations positions them at the forefront of modern compliance strategies.

However, it’s crucial to involve human intervention when and where necessary to navigate the ethical considerations and continuously refine these technologies to foster a compliant and trustworthy financial ecosystem. Because AI and ML are powerful technologies that operate based on data and algorithms. This inherent limitation can result in challenges when facing novel situations or making nuanced judgments that require human intuition, ethics, and creativity.

Corestrat’s suite of AI & ML tools, Intelligent Decision Studio (IDS), simplifies compliance adherence, freeing decision-makers to focus on critical tasks such as strategy formulation and many other important things that require their intervention the most. For more details visit : http://52.22.170.227/solutions/intelligent-decision-studio/

Skip to content

Skip to content