- Solutions

- Insights

- Company

- Get in Touch

Lendsphere

Innovative co-lending platform that helps banks, NBFCs and other eligible lending agencies to collaborate and lend money to borrowers

Why choose Lendsphere for co-lending?

A customisable smart platform tailored to meet the specific needs of partners and clients

Effortless collaboration

Partners can independently onboard customers using their existing systems, facilitating effortless collaborationAutomated decisions

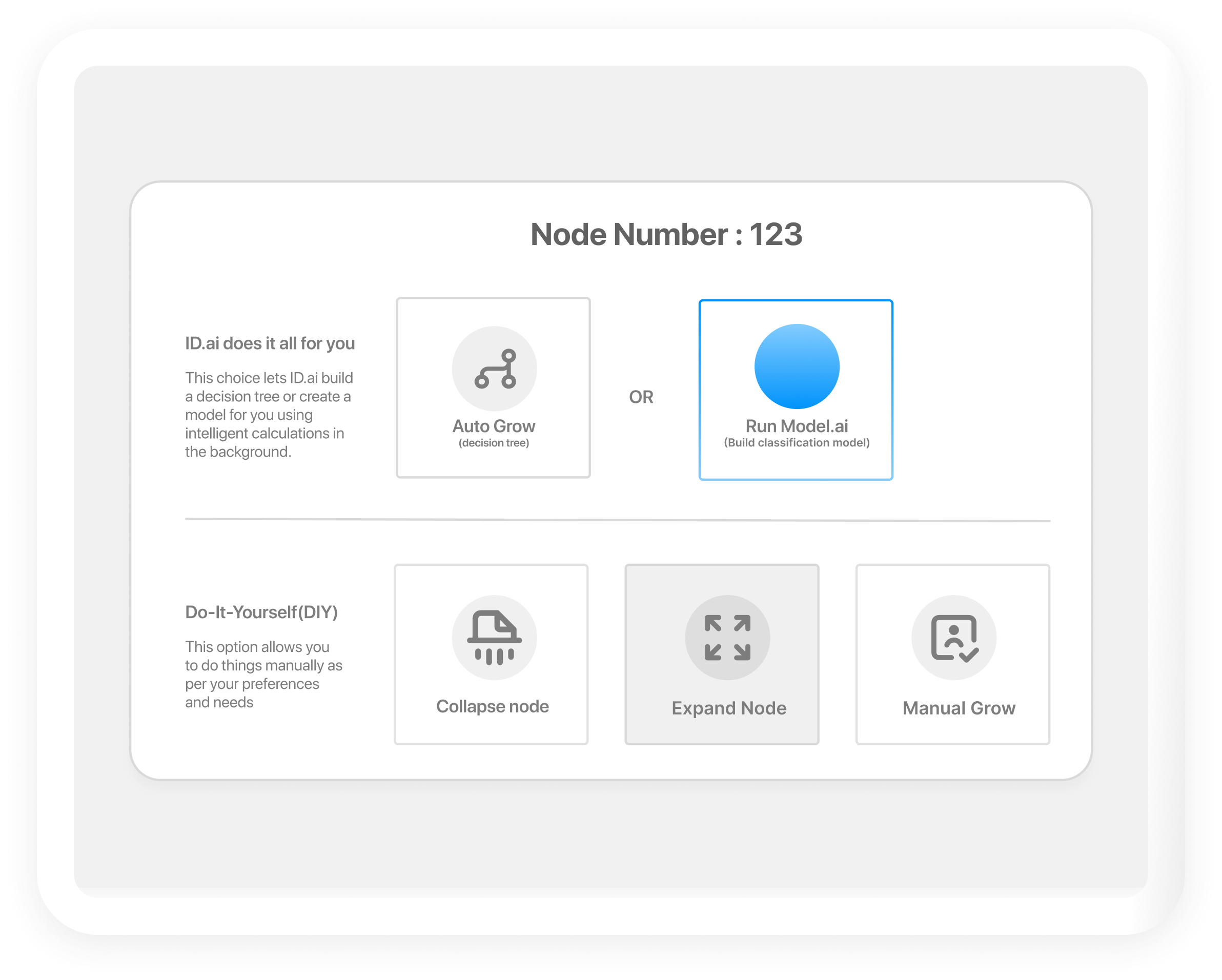

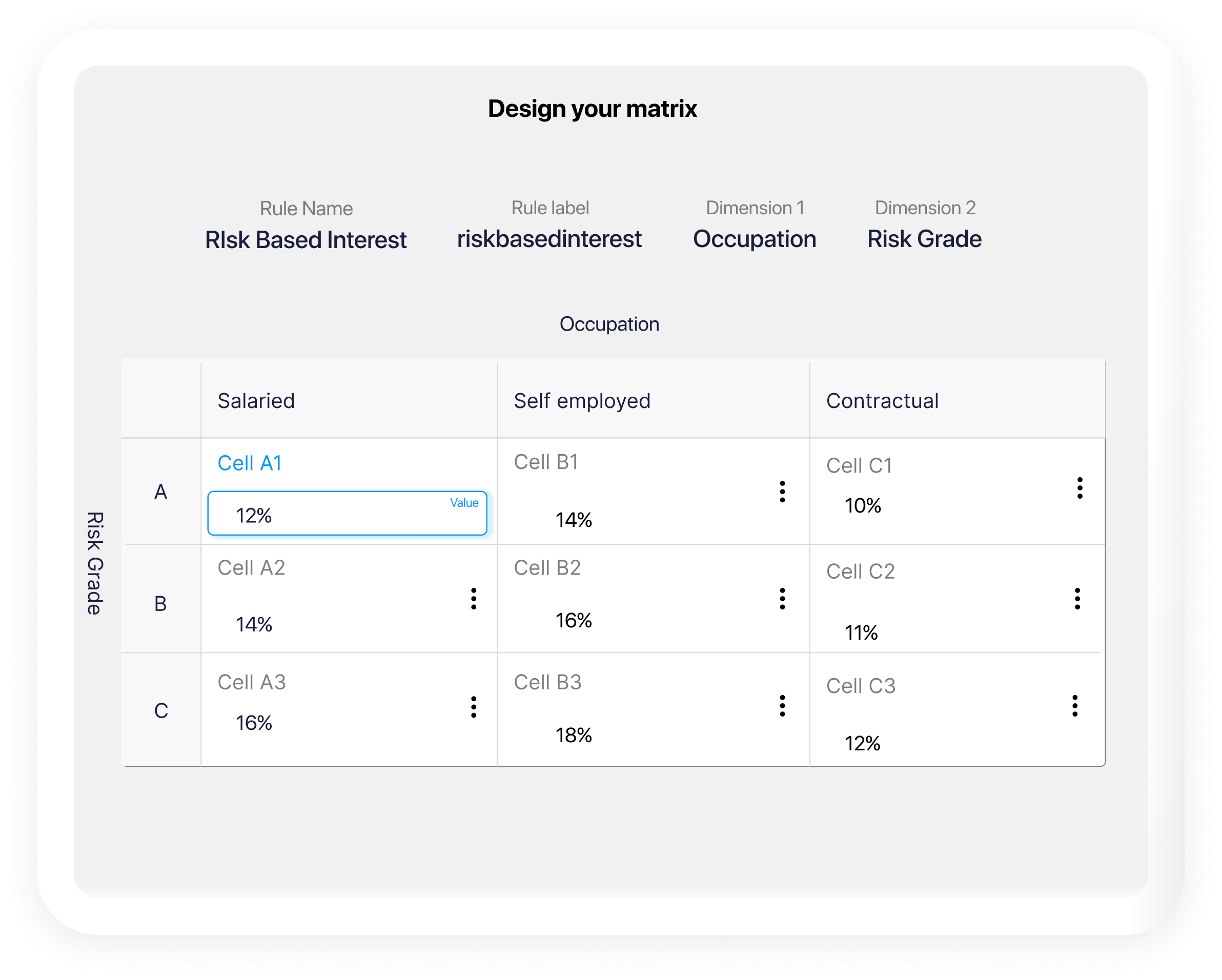

Automated decisions

With the integrated Rule.ai, Lendsphere approves and disburses the loan automatically in a matter of minutes

Customisable

Improve speed and accuracy with consistent, data-driven processes, leading to greater operational efficiency

Lendsphere - An AI-powered platform enabling lenders to share credit risk and resources efficiently

Its flexible APIs enable seamless integration with existing systems, establishing a shared account structure for collaborative fund management

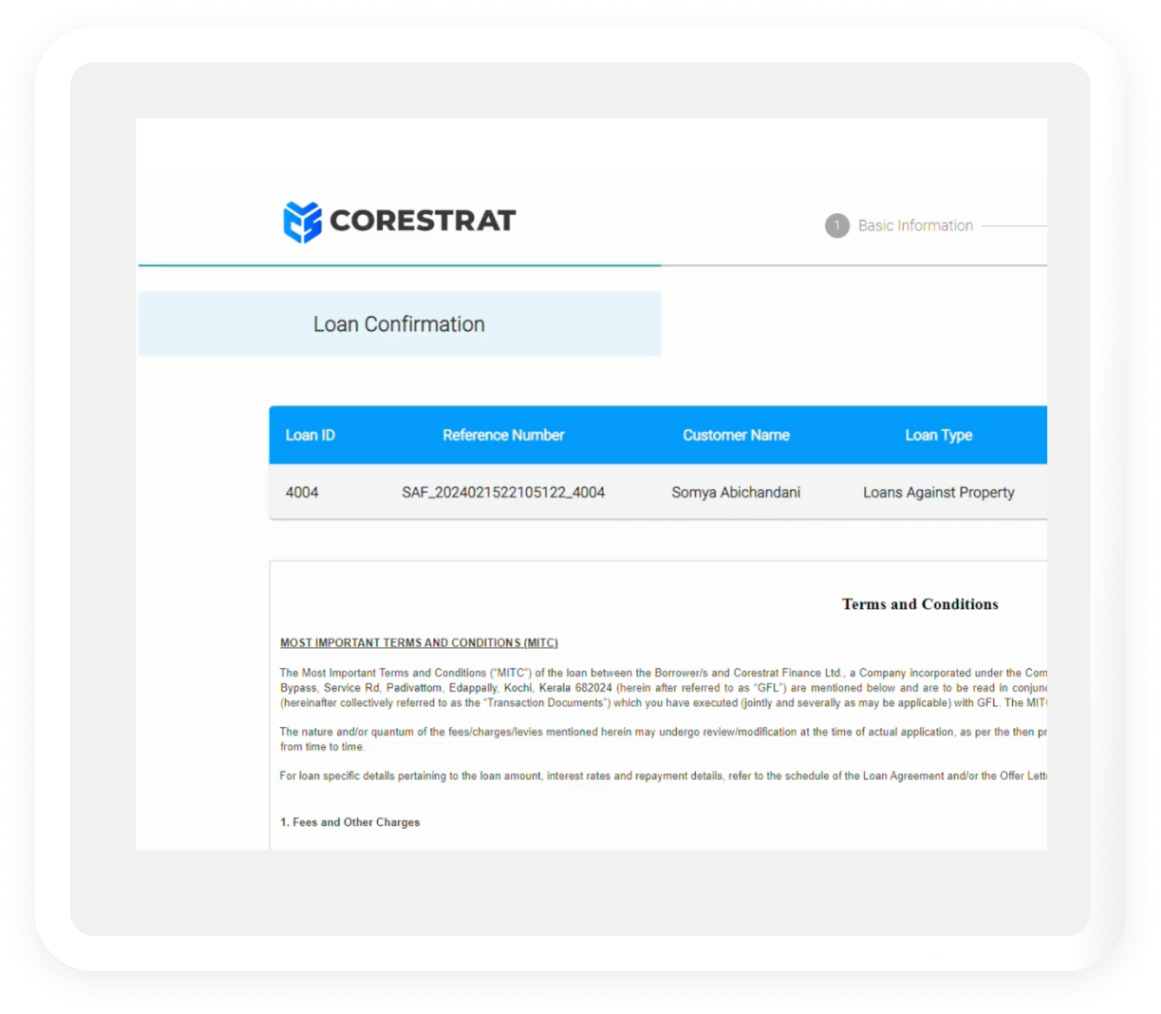

Easy onboarding

Effortlessly onboard multiple lenders using various loan origination systems, enabling resource sharing to extend loans to eligible borrowers

API integration

Enables partner loan origination systems to connect and share data effortlessly with one-time API integration

Fractional repayments

Repayments can be scheduled fractionally for all lenders involved, corresponding to the portion of the loan each lender provided

Collaborative underwriting

Lending partners can assess loan applications and complete the credit appraisal, empowering them to make informed decisions

Shared infrastructure

Establish a shared account structure to facilitate joint fund management, allowing for unified disbursement and repayment processes

Intuitive interface

A user-friendly interface to easily set up and manage co-lending agreements, define partner structures and track transactions in real time

Corestrat's offerings

Why choose Corestrat?

Scalable & secure

Our solutions are built on cloud-native architecture, ensuring scalability, security, & easy integration with your existing systems

Proven expertise

With years of expertise in AI-powered risk management & decision automation, we’ve become a trusted partner for leading organisations

Tailored solutions

Every institution has unique challenges & goals, so our AI-powered solutions are flexible, customisable, & built to adapt to your needs

Innovative approach

We prioritise innovation, rigorous analytics and due diligence to deliver intelligent, future-ready solutions