- Solutions

- Insights

- Company

- Get in Touch

Digital Lending Automation (DLA)

Enables lenders to automate lending decisions while evaluating risks for new credit origination and/or for management of existing credit exposures.

Why choose DLA to automate lending operations?

Enables lenders to make smart decisions, consistently across channels and partners, that are instant, transparent and compliant.

Improved efficiency

Reduces manual effort, eliminates paperwork, and speeds up the lending process, resulting in quicker & efficient decision-making.

Enhanced accuracy

Automated systems minimise human errors and ensure consistency in credit risk assessment, lending decisions and documentation

Better customer experience

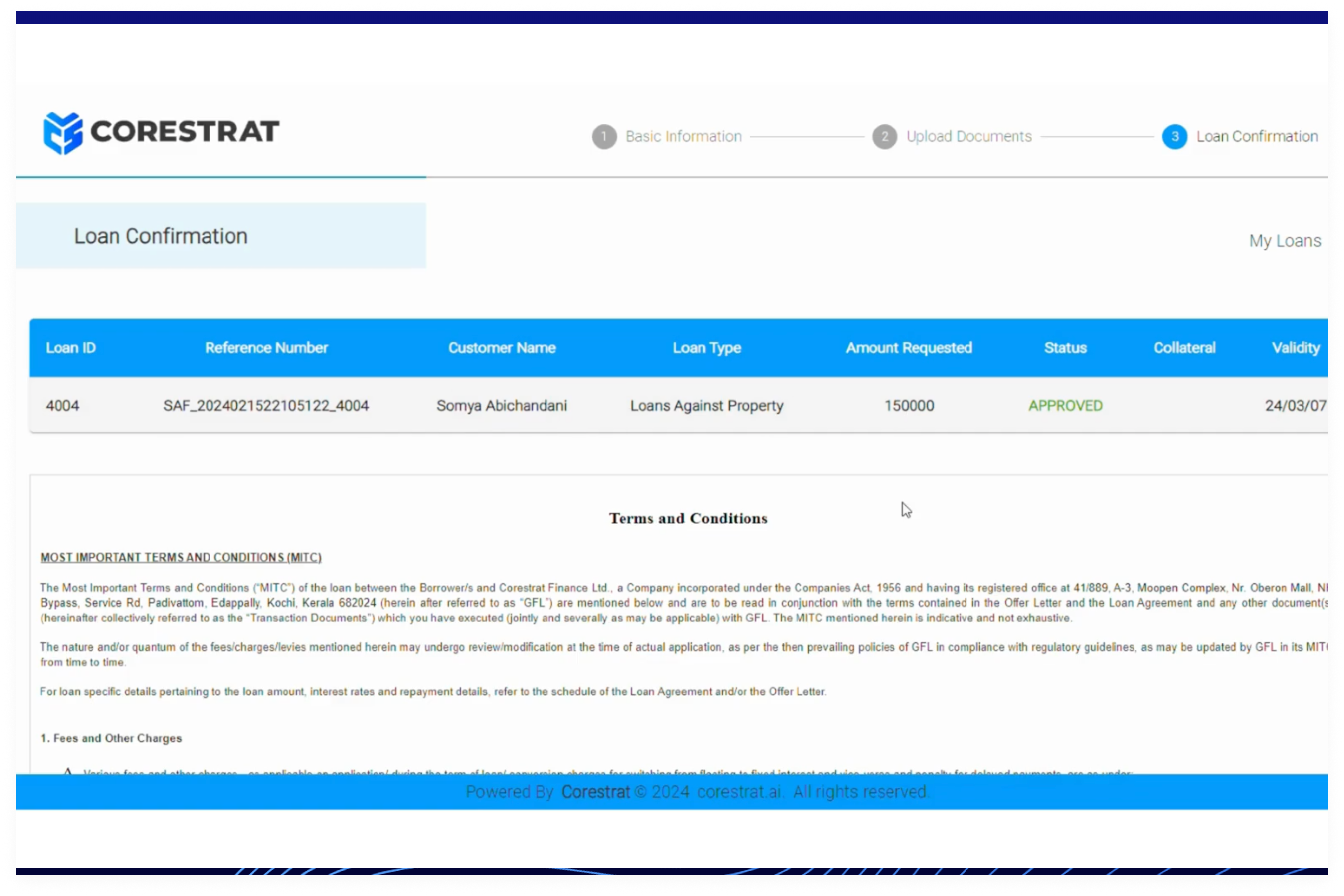

Enables a seamless and convenient borrowing experience, with online applications, faster decisions, and 24/7 accessibility.

Digital Lending Automation - Lending automation platform for lenders of all size

Ensures full control over the lending decisions that are data-driven, auditable and traceable for better risk management.

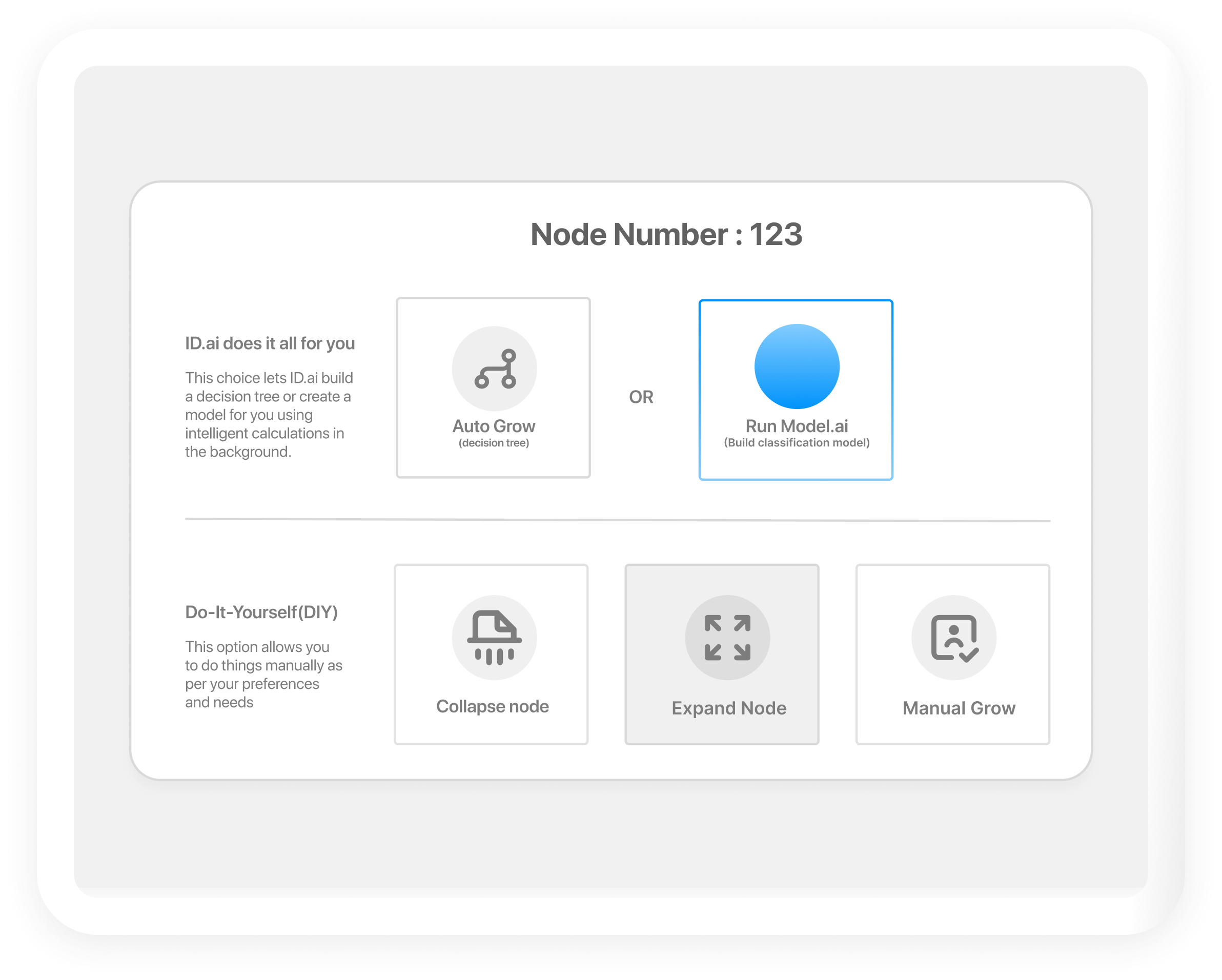

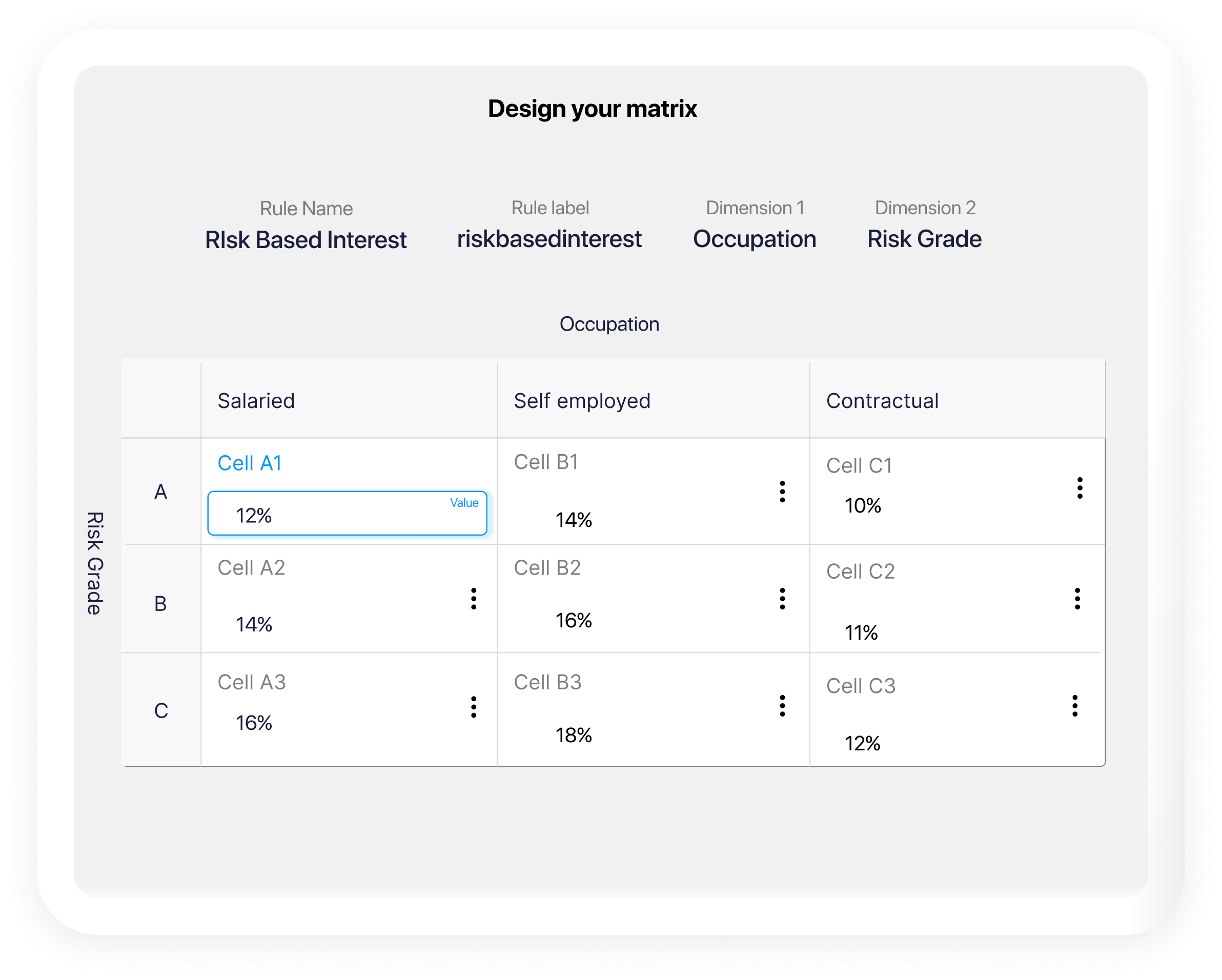

Built-in risk decisioning

Built-in decision segmentation capability helping lenders identify and target customer segments with tailored and risk-informed offers.

Microservices architecture

Highly adaptable & easily integrates with a wide range of existing systems & applications within the organisation through DLA’s API interface.

Modular workflow

Automate data-driven lending decisions by creating strategies through a powerful integrated rule engine without having to write a line of code.

Real-time monitoring

Intelligent monitoring displaying relevant information on customisable monitoring reports, & points to causation-based answers & proactive, actionable insights.

Effective risk management

Uses credit bureau and partner ecosystems data to evaluate borrower credit risk and enhance risk management.

Effortless model deployment

Seamless integration of new or updated decision models into existing workflows for application-level scoring

Corestrat's offerings

Frequently Asked Questions

The digital lending process refers to a loan acquisition approach wherein borrowers can conveniently apply for and obtain loans via online platforms, eliminating the need to personally visit a physical bank or lending institution.

Why choose Corestrat?

Scalable & secure

Our solutions are built on cloud-native architecture, ensuring scalability, security, & easy integration with your existing systems

Proven expertise

With years of expertise in AI-powered risk management & decision automation, we’ve become a trusted partner for leading organisations

Tailored solutions

Every institution has unique challenges & goals, so our AI-powered solutions are flexible, customisable, & built to adapt to your needs

Innovative approach

We prioritise innovation, rigorous analytics and due diligence to deliver intelligent, future-ready solutions