In today’s dynamic financial landscape, credit risk management has emerged as a top priority for financial institutions. With recent headlines highlighting challenges such as rising inflation, uncertain interest rates, and evolving market conditions, ensuring long-term sustainability has become a paramount concern. Credit risk, defined as the potential for borrowers to default on their loans, poses a significant threat to lenders, potentially leading to substantial financial losses. As a result, effective measurement and management of credit risk have become imperative for maintaining a healthy lending environment.

Traditionally, banks and financial institutions relied on conventional methods, such as financial statement analysis and credit scoring, to gauge credit risk. However, these methods are not always effective in today’s complex financial markets. As a response to this ever-evolving landscape, the fintech era has ushered in a wave of transformative technologies, data analytics, and automation, revolutionizing the credit risk assessment process. Lending practices have shifted towards a future-oriented approach, and the integration of predictive analytics has become a crucial asset for institutions aiming to remain at the forefront of innovation. Credit risk models, once confined to specific stages of the lending process, now play a pivotal role throughout the entire credit lifecycle. From initial loan origination to ongoing monitoring and portfolio management, these models offer valuable insights that empower credit risk analysts to make informed decisions.

In this article, we delve into the realm of credit risk management and decision analytics, exploring how advanced technologies and data-driven approaches have transformed the industry. We will examine the benefits of leveraging predictive analytics to enhance risk assessment, decision-making, and overall risk management. Furthermore, we will discuss the importance of selecting the right partner to ensure effective credit risk management and successful integration of advanced analytics.

Challenges faced by financial companies in traditional credit risk assessment

Companies often face several challenges when relying solely on traditional credit risk measuring techniques. Some of these challenges include:

Limited Data Sources: Traditional credit risk measurement techniques often rely heavily on historical credit data from traditional credit bureaus.

Inadequate Risk Segmentation: The oversimplified risk category segmentation such as low, medium, or high-risk may not capture the nuances and variations in credit risk within each category.

Human Bias and Subjectivity: Traditional credit risk measurement techniques can undermine the accuracy and reliability of credit risk measurement.

Regulatory Compliance: Regulatory requirements related to credit risk measurement, such as stress testing or compliance with Basel III guidelines, are becoming more stringent.

Lack of Real-time Information: Traditional techniques typically rely on periodic updates of credit reports and financial statements. Real-time data on borrower behavior, economic indicators, or market trends is often not adequately incorporated, leading to outdated risk evaluations.

Inability to Capture Complex Relationships: Traditional credit risk measurement techniques may struggle to capture complex interdependencies and relationships between various credit risk factors. They may overlook subtle correlations or nonlinear relationships, limiting the accuracy and precision of credit risk assessments.

Not using optimum tools for credit risk assessment: Traditional credit risk measurement techniques often rely on simple scoring models or rule-based approaches. These methods may not fully leverage advanced analytics which can result in suboptimal risk predictions and missed opportunities for improved credit risk measurement.

What is credit risk analytics?

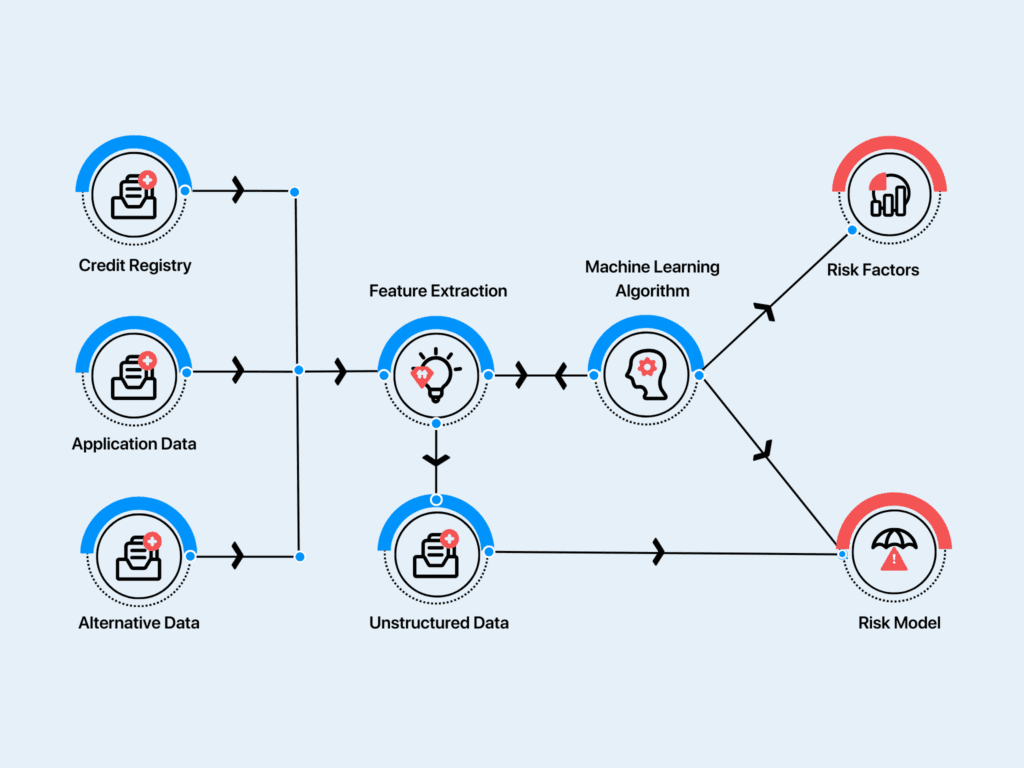

Credit risk analytics refers to the use of data analysis and statistical techniques to assess and manage the credit risk associated with lending and borrowing activities. It involves the application of quantitative methods and models to evaluate the likelihood of default or credit loss for individual borrowers or a portfolio of loans.

Credit risk analytics aims to provide insights and predictions about the creditworthiness of borrowers, allowing lenders to make informed decisions regarding credit approvals, loan pricing, and risk mitigation strategies. By analyzing historical data, current financial indicators, and relevant risk factors, credit risk analytics helps lenders assess the probability of repayment and potential credit losses.

Latest Trends in Credit risk scoring and technology

Credit risk scoring and measurement technology are constantly evolving to keep up with changing market conditions and customer behavior.

Artificial Intelligence and Big Data Analytics: The ability of Big Data Analytics to assess and analyse high volumes of data in minimal time gives an edge to fintech companies utilizing this technology. AI is being increasingly used to develop more sophisticated credit risk models that can better predict the likelihood of default.

The use of real-time data: Credit risk models are becoming more dynamic, using real-time data to update risk assessments. This allows lenders to make more informed decisions about creditworthiness, and to adapt their lending practices to changing market conditions. With the rise of digital banking, lenders can now monitor borrowers’ credit profiles in real-time. This can help lenders identify potential risks and take proactive measures to mitigate them.

The use of cloud computing: Cloud computing is making it easier and more cost-effective for lenders to implement credit risk scoring and measurement technology. Cloud-based solutions can provide lenders with access to the latest data and analytics, and can help them to scale their operations as needed.

Decision Science and Predictive Analytics: Predictive analytics leverages advanced statistical models and machine learning algorithms to analyze historical data, identify patterns, and predict credit risk outcomes. Decision science provides a framework for integrating these predictive insights into the decision-making process by considering various risk factors, trade-offs, and decision criteria. By combining predictive analytics and decision science in credit risk measurement, organizations can make more informed and data-driven credit risk decisions, improve risk assessment accuracy, optimize risk mitigation strategies, and enhance overall portfolio management practices. This integration enables lenders to effectively manage credit risk, minimize losses, and maintain a healthy credit risk profile.

Use of blockchain technology: Blockchain technology allows for secure, transparent, and tamper-proof record-keeping. This can help lenders reduce fraud and improve the accuracy of credit risk assessments.

Automated analytics and reports: There is an increasing focus on upgrading and automating reporting and analytics so that the data that influences decision-making is as accurate as possible. This can be done by automating data entry, report generation and the use of handy dashboards that display the data required in the most meaningful way possible to ensure it is as accurate and clear as possible.

How Corestrat helps clients

Corestrat, with its deep expertise in credit risk analytics and data management, offers comprehensive solutions to financial services firms for effective credit risk measurement. Our end-to-end suite of analytics solutions empowers clients to rapidly develop new credit risk models, seamlessly deploy them into production, and optimize decisioning strategies.

By leveraging advanced analytics and machine learning techniques, Corestrat enhances risk assessment accuracy and empowers automated decision-making processes. Additionally, our solutions focus on improving the user experience, making credit risk measurement more accessible, transparent, and efficient. With continuous monitoring and model retraining capabilities, Corestrat ensures that credit risk models evolve and improve over time, delivering enhanced performance and risk management outcomes for clients.