In today’s fast-paced business landscape, where data is abundant and decisions must be made swiftly and accurately, the need for robust decision management software has become more critical than ever before. Whether in finance, healthcare, retail, or any other industry, organisations are grappling with increasingly complex challenges that demand sophisticated solutions. With vast amounts of data to process, complex regulations to adhere to, and the demand for personalised customer experiences, organisations are increasingly turning to decision management software and solutions to navigate these challenges effectively.

Decision management software enables organisations to automate, optimise, and streamline their decision-making processes across various functions, such as risk management, compliance, fraud detection, and customer relationship management. By leveraging advanced analytics, machine learning algorithms, and predictive modelling, these solutions empower businesses to make data-driven decisions quickly and accurately.

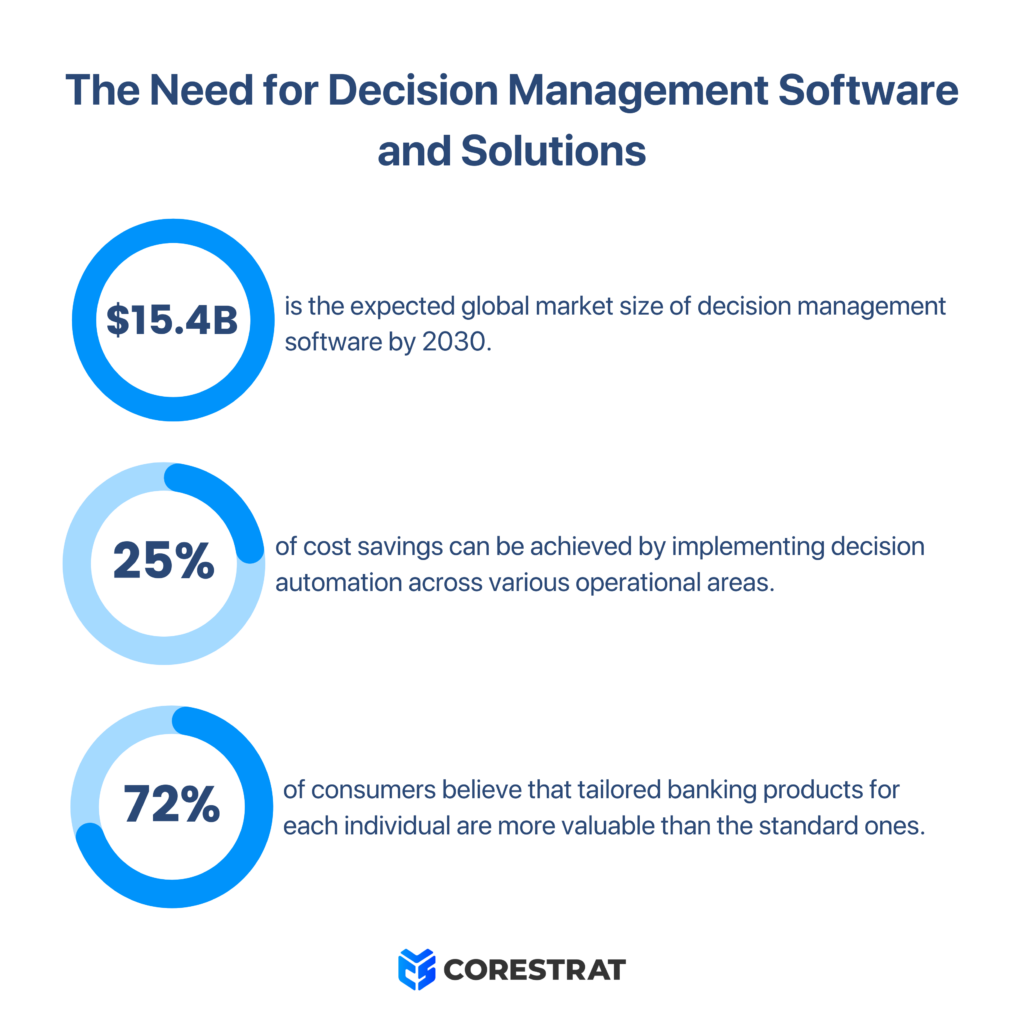

With the global decision management market projected to grow from $5.25 billion in 2023 to $15.49 billion in 2030 at a CAGR of 16.7%, let us learn more about the importance of decision management software while exploring its benefits, applications, and impact it brings to the table.

Benefits of Decision Management Software

Accuracy and Consistency: Decision management software eliminates human errors and biases, ensuring decisions are based on predefined criteria and data-driven insights. This consistency minimises the likelihood of costly mistakes and enhances compliance with regulatory standards.

Scalability: As modern-day organisations handle growing volumes of data and transactions, decision management software scales effortlessly to meet increasing demands. Whether it’s processing loan applications or detecting fraudulent activities for financial services, or managing the inventory in a large warehouse, these platforms can handle large workloads efficiently, without compromising accuracy or speed.

Speed and Efficiency: Decision management software accelerates decision-making processes, reducing the time required to analyse data and execute actions. For instance, loan approval decisions that once took days can now be made within minutes, leading to faster customer service and increased satisfaction.

Risk Management: According to a report by McKinsey & Company, financial institutions can achieve cost savings of up to 25% through the implementation of decision automation across various operational areas, including loan processing, risk management, and compliance. By integrating predictive analytics and machine learning algorithms, decision management software enhances risk management capabilities. It enables proactive identification of potential risks and anomalies, allowing organisations to take preemptive measures to mitigate losses and safeguard assets.

Applications of Decision Management Software in Financial Services

From healthcare to financial institutions, decision management software is instrumental in driving the growth of an organisation. Here are a few examples demonstrating the diverse applications of decision management software across various sectors, bolstering process enhancement.

Fraud Detection and Prevention: Decision management software employs advanced analytics to detect fraudulent activities in real-time, such as unauthorised transactions, identity theft, and account takeover attempts. Financial institutions can mitigate fraud losses and protect their customers’ assets by flagging suspicious behaviours and anomalies.

Inventory Management: Decision management software helps retailers optimise inventory levels, minimise stockouts, and reduce excess inventory. By analysing historical sales data, supplier lead times, and demand forecasts, retailers can automate replenishment processes, set optimal reorder points, and ensure the right products are available at the right time and place.

Customer Service and Personalisation: According to reports, 65% of consumers agree that banks should make it easier while offering their products, and 72% believe that tailored products for each individual are more valuable than the standard ones. Decision management software enhances customer service by delivering personalised recommendations, tailored product offerings, and targeted marketing campaigns. By analysing customer preferences, transaction histories, and behavioural data, organisations can anticipate their clients’ needs and provide timely, relevant solutions.

Conclusion

As organisations continue to navigate an increasingly complex and data-driven business environment, the adoption of decision management software and solutions has become imperative for survival and success. By harnessing the power of data analytics and automation, businesses can gain a competitive edge, drive operational efficiency, and achieve better outcomes across every facet of their operations. In a world where every decision counts, decision management software is the key to unlocking untapped potential and charting a path towards a brighter, more prosperous future.

Decision Management Suite (DMS) by Corestrat is one such decision management software that helps organisations to build and deploy smart workflows for real-time decision-making. It is a suite of products that contains a predictive model builder in the form of Model.ai and a decision simulator ID.ai, which helps the users to streamline the decision-making process by eliminating the need for coding or intricate machine learning models.

Learn more about automated decision-making and decision management through our DMS: http://52.44.229.231/solutions/decision-management-suite/