Portfolio Science

Decision Solutions

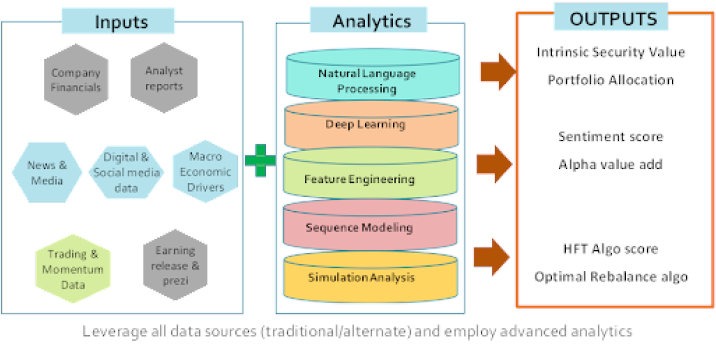

CDS PortfolioScience is based on augmented intelligence – developing a powerful and integrated analytical framework solution that mosaics the structured and unstructured data with human expertise to enable a radical market shift in leveraging big data for dynamic decisions.

Portfolio algorithms drive business value:

-

- Enables you to extract maximum value from all available data assets, no matter their location or format.

- Predictive models for SMART business insights to drive growth and profitability.

Corestrat’s proprietary, finance-specific machine learning algorithms identify patterns based on diverse inputs leading to enhanced idea generation, improved accuracy and robust risk management for optimal portfolio construct:

-

- Individual security valuations based on analysis of fundamental, sentiment, analytics insights and trading momentum.

- Dynamically ranked security selection driven by user risk-return criteria based on your goals and objectives.

- Advanced portfolio construction tools to optimize portfolio performance.

- Comprehensive back tested model