The world of finance has witnessed a technological revolution in recent years, and fintech has emerged as a game-changer. Fintech companies offer innovative financial products and services, from digital payments and peer-to-peer lending to robo-advisors and blockchain-based solutions.

However, with this rapid growth and technological advancement come inherent risks that must be managed effectively. This is where risk modelling steps in – a vital practice in the fintech landscape that enables companies to navigate uncertainty, protect their stakeholders, and ensure sustainable growth.

What Is Risk Modelling?

Risk modelling in fintech refers to the process of using mathematical and statistical techniques to analyse and predict potential risks associated with financial transactions, products, or portfolios within the financial technology (fintech) industry.

Fintech companies often deal with large volumes of data, including customer information, transaction history, and market data. Risk modelling allows them to assess and manage various risks to make informed decisions and protect their businesses and customers.

Why Is Risk Modelling Important In Fintech?

Risk modelling plays a crucial role in fintech for several reasons. As fintech companies operate in the financial industry, they deal with sensitive data and transactions, making risk management essential for their success and the safety of their customers. Here are some key reasons why risk modelling is important in fintech:

Risk Assessment and Mitigation: Fintech companies handle various financial services, such as online payments, lending, investment, and insurance. Risk modelling helps assess and quantify potential risks associated with these services. By identifying and understanding risks, fintech firms can implement effective risk mitigation strategies to protect themselves and their customers.

Regulatory Compliance: The financial industry is heavily regulated, and fintech companies are no exception. Risk modelling aids in understanding compliance requirements and ensuring that the company adheres to the relevant regulations and standards. Compliance failures can lead to severe penalties and reputational damage, making risk modelling vital for maintaining legal and regulatory compliance.

Fraud Detection and Prevention: Fintech platforms are attractive targets for fraudsters due to the high volume of transactions and sensitive information involved. Risk models can help detect suspicious activities and patterns, enabling timely fraud prevention measures to protect customers and the company’s assets.

Credit Risk Assessment: Fintech companies often provide lending and credit services. Risk modelling helps evaluate the creditworthiness of borrowers by analysing their financial data, transaction history, credit scores, and other relevant factors. This ensures that loans are extended to customers who are more likely to repay them, thus optimising the credit risk and minimising the potential losses.

Cybersecurity: Cybersecurity risks pose significant challenges to fintech companies. Risk modelling aids in identifying vulnerabilities and potential cyber threats. By understanding these risks, companies can implement robust cybersecurity measures to protect their systems and customer data from breaches and cyberattacks.

Stress Testing: Risk modelling allows fintech companies to conduct stress tests on their systems and operations. Stress testing simulates extreme scenarios to assess the company’s resilience to adverse market conditions, economic downturns, or operational failures.

Customer Trust and Reputation: Fintech companies heavily rely on customer trust. Implementing effective risk modelling practices demonstrates the company’s commitment to safeguarding customer interests, thereby enhancing trust and reputation among existing and potential customers.

Traditional Approaches To Risk Modelling

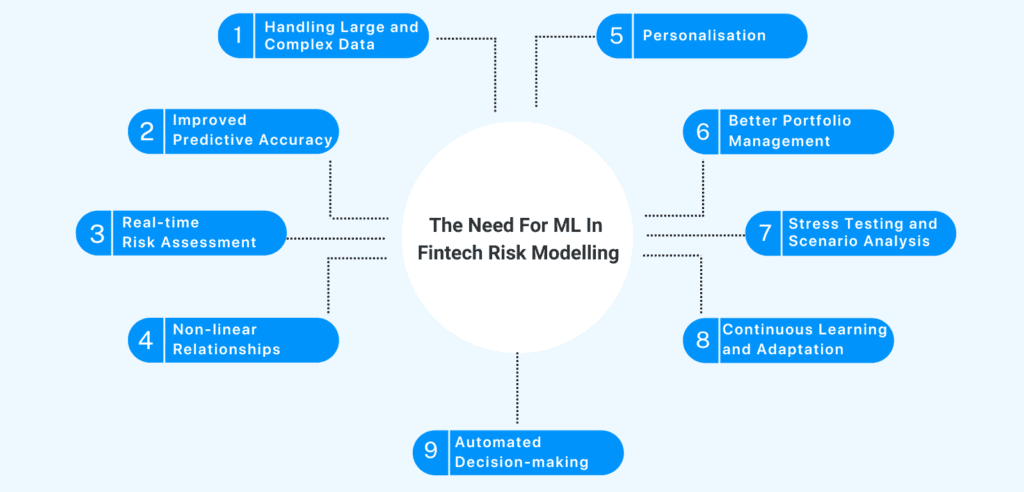

Machine Learning (ML) plays a crucial role in fintech risk modelling due to several reasons, as it offers several advantages over traditional approaches. The complexity and volume of financial data in the fintech industry make ML an ideal tool for risk assessment and mitigation. Here are some key reasons why ML is needed in fintech risk modelling:

Handling Large and Complex Data: Fintech companies deal with massive amounts of structured and unstructured data, including transaction records, user behaviour, market data, social media sentiments, and more. ML algorithms can efficiently process and analyse this data, identifying patterns and relationships that may not be apparent using traditional methods.

Improved Predictive Accuracy: ML algorithms are designed to learn from data and adapt over time, leading to more accurate predictions. They can identify subtle trends and relationships in data, allowing for more precise risk assessment and modelling.

Corestrat’s Model.ai is one such predictive analytics tool that helps users build and deploy classification and/or regression models in a few clicks to help in decision-making.

Real-time Risk Assessment: Risk management in the financial sector is way more important than one can imagine. As Fintech operates in a fast-paced environment, real-time decisions are critical for managing these risks. ML models can process data and make risk assessments in real time, enabling prompt responses to emerging risks and potential threats.

Non-linear Relationships: Financial markets and risk factors often exhibit non-linear relationships, making them challenging to model accurately using traditional linear methods. ML algorithms, such as neural networks and decision trees, can capture these non-linearities effectively.

Personalisation: ML enables personalised risk modelling and credit scoring. By considering individual customer behaviour, transaction history, and other relevant factors, ML models can tailor risk assessments to each customer, resulting in more accurate risk profiles and better customer experiences.

Better Portfolio Management: ML can assist in optimising portfolio allocation based on risk-return trade-offs and changing market conditions. ML models can continuously adjust portfolio compositions to meet risk management goals and maximise returns.

Stress Testing and Scenario Analysis: ML can facilitate complex stress testing and scenario analysis by simulating a wide range of potential outcomes based on diverse variables. This capability enhances risk managers’ ability to assess a portfolio’s resilience under various adverse conditions.

Continuous Learning and Adaptation: ML models can adapt to changing market dynamics and continuously learn from new data. This adaptability allows risk models to stay up-to-date and relevant in dynamic financial environments.

Automated Decision-making: ML enables the automation of risk management processes, reducing human error and increasing operational efficiency. Automated risk models can quickly analyse data and provide actionable insights, freeing up human resources to focus on higher-level tasks.

While ML brings significant benefits to fintech risk modelling, it is essential to address challenges such as model interpretability, data privacy, and bias mitigation. Combining ML with domain expertise and oversight by risk management professionals can ensure the responsible and effective application of ML in fintech risk modelling.

Conclusion

Risk modelling is indispensable in fintech due to the industry’s unique characteristics, including the reliance on technology, financial transactions, and sensitive data. By employing risk modelling techniques, fintech companies can identify, understand, and mitigate risks, ensuring the sustainability and success of their operations while maintaining the trust and confidence of their customers.

Corestrat’s Intelligent Decision Studio, a suite of products which are specifically developed to manage risks for the financial industry can help in risk modelling for the modern fintechs. Using this suite of products organisations can evaluate risks and use data to their advantage to make informed decisions.