Credit scores and traditional credit data have historically been the primary tools used by lenders to assess a borrower’s creditworthiness and ability to repay loans. However, this system effectively excludes millions of consumers who have little or no traditional credit history from accessing credit. Additionally, even for those with robust credit files, traditional credit data, at times, provides an incomplete picture of someone’s full financial situation and repayment risk.

This is where alternative data has emerged as a powerful complement to traditional credit data for credit risk assessment. A 2023 study of 225 senior decision-makers in U.S. financial institutions found that 65% use alternative credit data for 50% to nearly 100% of new applicants. As a result, over half of them reported a lending revenue increase of 15% or more. Therefore, when used responsibly and ethically, alternative data allows lenders to develop a more comprehensive view of a borrower’s financial behaviours and risk profile.

What is Alternative Data for Credit Risk Management?

Alternative data refers to non-traditional information sources that can provide insights into an individual’s or business’s creditworthiness and help in credit risk management during the lending process. This data can be gleaned from a variety of channels, including:

Financial Transactions: Bank account information (with permission), prepaid debit card usage, and money transfer services can reveal spending habits and financial management skills.

Utility and Telecom Bills: On-time payments for utilities, phone, and internet services can indicate responsible financial management.

Rental Payments: Consistent rent payments demonstrate a strong commitment to financial obligations.

Public Records: Court records, taxes, and business registrations can reveal potential financial issues.

Social Media Data: While controversial, some lenders analyse social media activity to gauge an individual’s financial stability and overall responsibility.

E-commerce Transactions: Purchase history and repayment behaviour on online platforms can provide insights into spending patterns and creditworthiness.

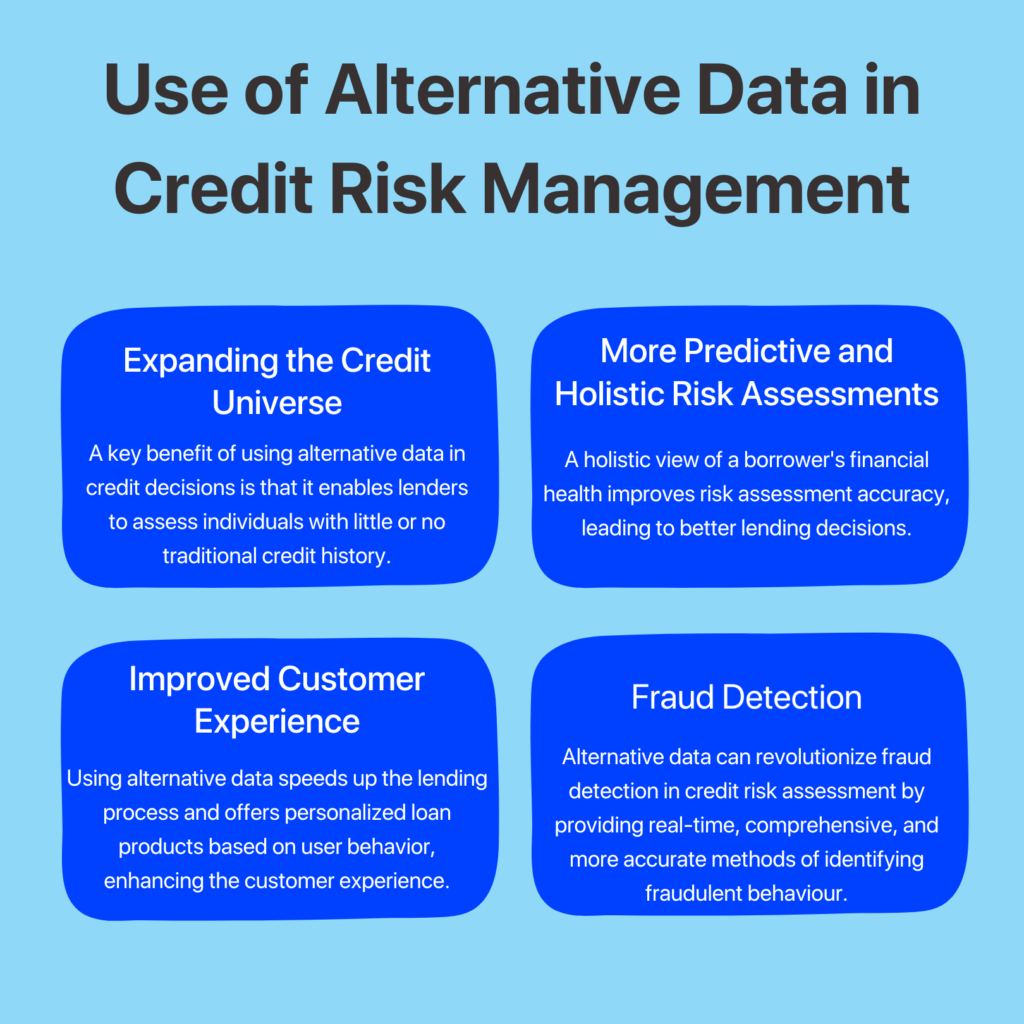

Expanding the Credit Universe

One of the primary benefits of incorporating alternative data into credit decisioning is that it allows lenders to evaluate individuals who have little or no traditional credit history, which is often referred to as having a “thin file” or being “unscored.” This group includes a significant portion of the population, including many young adults, the underbanked, and those who prefer using alternative financial services or cash.

With little data contained in their traditional credit reports, these consumers have generally been difficult for mainstream lenders to properly assess based on traditional underwriting methods. According to a study, 90% of lenders view alternative data as essential for approving more creditworthy borrowers. By considering things like positive rent, utility, and telecom payment histories, lenders can gain valuable insight into these individuals’ financial habits and discipline in meeting recurring payment obligations. This allows lenders to make more informed decisions and extend credit opportunities to people who have been excluded in the past.

More Predictive and Holistic Risk Assessments

Even for consumers with long credit histories, traditional credit data misses key signals about income, assets, spending patterns, cost of living, financial obligations, and other important details that impact one’s debt repayment risk. For instance, someone with a high debt load who recently started a high-paying job is likely lower risk than someone who earns very little income with the same amount of debt.

Alternative data can fill in these critical gaps and give a more complete picture of each borrower’s financial standing and cash flow dynamics. Trends in deposits, investment holdings, bill payments, location data, purchase transactions, and public data can enhance the predictive power of credit scoring models beyond just payment histories. Lenders can develop more holistic, personalised risk assessments and better match consumers with the appropriate loan products, terms, and loan amounts given their unique financial capacities and situations.

Improved Customer Experience

Alternative data can help speed up the lending process as it can reduce the lengthy verification of documents and waiting for credit bureau reports which can be a frustrating experience for customers. It can be used to generate pre-approval offers with personalised interest rates based on a borrower’s unique financial profile. This empowers borrowers to shop around with confidence, knowing their creditworthiness has been assessed beforehand.

By understanding a borrower’s financial habits and needs through alternative data, lenders can present them with tailored loan options that best suit their situation. Also, faster credit analysis facilitated by smart lending platforms allows lenders to communicate with borrowers more efficiently, keeping them informed throughout the application process. A smoother application process with faster approvals can significantly improve customer satisfaction. Borrowers appreciate a hassle-free experience and the transparency that comes with receiving a quick decision based on a comprehensive assessment of their financial profile.

Fraud Detection

Alternative data holds the potential to transform fraud detection in credit risk assessment, offering real-time, comprehensive, and more accurate methods of identifying fraudulent behaviour. By incorporating diverse data points such as social media activity, utility payments, geolocation, and e-commerce transactions, financial institutions can detect fraud patterns that conventional methods might miss. As technology and data analytics continue to evolve, the integration of alternative data will undoubtedly become a cornerstone of modern fraud detection strategies during credit risk assessment.

Conclusion

Alternative data offers a transformative opportunity for the financial industry to enhance credit risk assessment. By providing a more inclusive, accurate, and real-time evaluation of creditworthiness, it enables lenders to make better-informed decisions and extend credit to a broader segment of the population. As the landscape of credit risk assessment evolves, those who adeptly harness the power of alternative data will be at the forefront of innovation and financial inclusion.

Corestrat’s Model.ai is a predictive model builder that assists lending institutions in evaluating a borrower’s creditworthiness using alternative data. It has already enabled a prominent Singaporean organisation, which previously had no experience in lending, to successfully enter the lending market. Model.ai is a powerful tool for predicting the credit risk of potential borrowers by leveraging all available data.

Learn more about assessing the worthiness of a borrower using alternative data with Corestrat’s Model.ai: http://52.44.229.231/solutions/no-code-ai-model-builder/

Learn more about Model.ai enabling a leading Singaporean digital bank manage their lending business and credit portfolio management: http://52.44.229.231/success-stories/