Lenders today recognise the transformative value of lending automation platforms and are gradually adopting these advanced solutions. From credit risk management to accelerating loan disbursal, loan origination systems have significantly improved the overall lending process. This not only elevates the borrower experience but also bolsters the profitability of lending organisations.

With digital lending automation platforms gaining much-needed traction, many lenders are eager to integrate these solutions into their services. Given that lending automation platforms are primarily cloud-based, users benefit from a wide array of advantages. The cloud infrastructure offers user-friendliness, seamless scalability, and superior flexibility, giving lenders a distinct edge over traditional, locally hosted lending solutions.

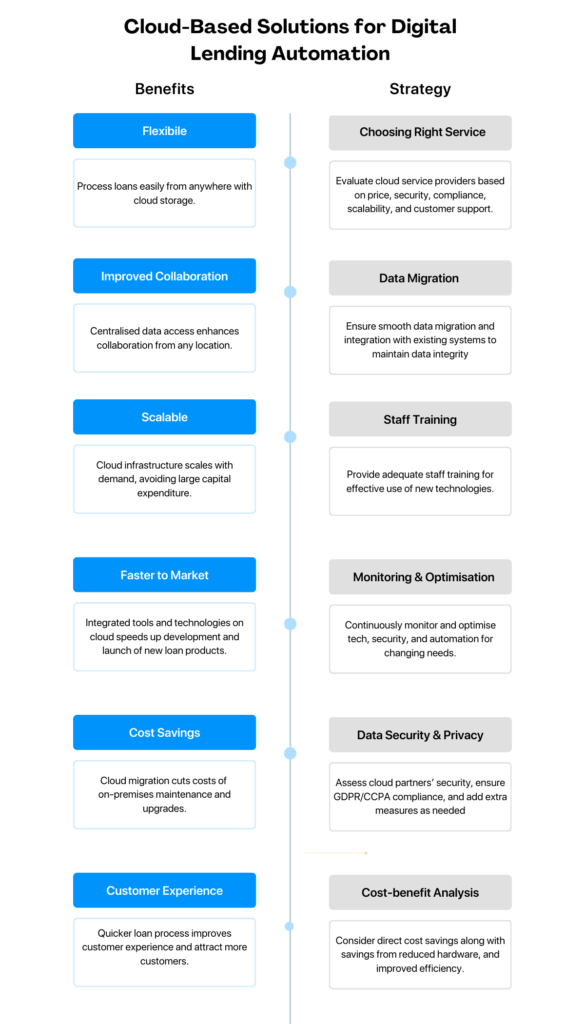

In this article, we will delve into the benefits and strategic considerations of cloud-based lending automation platforms.

Benefits of Cloud-Based Digital Lending Automation Platforms

Flexibility

With all data, tools, and technology stored in the cloud, lenders have the flexibility to handle the lending process from anywhere. This capability allows for immediate review and processing of borrower applications.

As there is no need for dedicated hardware or infrastructure for storage and processing, it gives lenders accessibility from any location at any time, removes location-based restrictions, boosts productivity and enhances the customer experience with faster service.

Improved Collaboration

A cloud-based digital lending platform stores everything remotely and is accessible to all relevant parties from anywhere. As a result collaboration becomes seamless. Centralised data access, real time communication and increased transparency leads to a better collaboration as they can connect from any location with all necessary details at their fingertips. This approach enables quicker and more efficient problem resolution.

The ability to collaborate effortlessly regardless of location significantly enhances team productivity and ensures that issues are addressed promptly. Consequently, this leads to improved operational efficiency and a more responsive service, ultimately benefiting both the lending organisation and its borrowers. By leveraging cloud-based solutions, lending institutions can foster a more dynamic and adaptable work environment, positioning themselves to better meet the demands of the modern financial landscape.

Scalable

One of the primary advantages of cloud-based solutions is their scalability. As per a study, 60% of the world’s corporate data is stored in the cloud, and by 2025, it is estimated that approximately 200 zettabytes of data will be cloud-based.

Lending institutions with traditional IT infrastructure often require significant investment in hardware and software, which can be a barrier to growth. In contrast, cloud-based systems can be scaled up or down based on demand without the need for substantial capital expenditure.

This enables lending institutions to efficiently manage the growing volume of loan applications while diversifying their offerings with various types of loans to expand their reach. As a result, these institutions can confidently accommodate a growing borrower base and innovate their business models without concern.

Faster to Market

With all technologies and tools seamlessly integrated in one place, launching new lending products becomes straightforward for lending institutions. Since they don’t need to make significant changes to their hardware and infrastructure to implement changes, they can quickly develop, analyse, and bring new loan products to market. This agility gives them a significant advantage over institutions relying on traditional infrastructure, enabling faster innovation, responsible lending and responsiveness to market demands.

Cost Savings

Research indicates that organisations can reduce their overall ownership costs by up to 40% through migrating their business operations to the cloud. By moving to the cloud, lenders can reduce the costs associated with maintaining and upgrading on-premises infrastructure. And with cloud service providers even offering pay-as-you-go pricing models, lenders can only pay for the resources they use. Additionally, the reduced need for physical infrastructure leads to lower operational costs.

Improved Customer Experience

All these aforementioned features not only enhance the lending process for institutions but also improve the overall borrower experience. With the ability to obtain loans quickly and avoid long waiting periods between application and disbursal, customers are more inclined to do business with these lending institutions. The ease of transactions fosters customer loyalty and helps build a strong reputation in the lending sector.

Strategic Considerations for Implementing Cloud-Based Digital Lending Automation Platforms

While the benefits of cloud-based digital lending automation platforms are clear, successful implementation requires careful planning and strategic considerations.

Choosing the Right Cloud Service Providers

Selecting the right cloud service provider is crucial. Lenders should evaluate providers based on factors such as price, security, compliance, scalability, and customer support. Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform (GCP) are among the most renowned cloud service providers. Depending on your specific needs, you can select one of these or any other provider that best suits your requirements.

Data Migration and Integration

Migrating existing data to the cloud can be a complex process. Lenders must plan their data migration strategy carefully to avoid disruptions and ensure data integrity. Additionally, cloud-based solutions should integrate seamlessly with existing systems and applications to provide a unified and efficient workflow.

Staff Training

Implementing cloud-based solutions often requires a shift in organisational structure and processes. Staff training is essential to ensure that employees are comfortable with new technologies and can leverage them effectively.

Continuous Monitoring and Optimisation

The digital lending landscape is constantly evolving, and lenders must continuously monitor and optimise their cloud-based solutions. This includes keeping up with technological advancements, regularly updating security measures, and refining automation processes to meet changing customer needs and market conditions.

Data Security and Privacy

While cloud providers offer robust security measures, lending institutions remain responsible for their customers’ data. It’s crucial to thoroughly evaluate the security protocols of potential cloud partners, ensure compliance with data protection regulations like GDPR or CCPA, and implement additional security measures as needed. Encryption, access controls, and regular security audits should be part of the overall strategy.

Cost-benefit analysis

While cloud solutions can offer significant cost savings, it’s important to conduct a thorough cost-benefit analysis. This should include not only the direct costs of the cloud service but also potential savings from reduced hardware and maintenance, improved efficiency, and faster time-to-market for new products.

Conclusion

As the lending industry continues to evolve, embracing cloud-based solutions for digital lending automation is crucial for staying ahead of the curve. Cloud-based solutions revolutionise the digital lending industry by providing enhanced efficiency, scalability, cost savings, and improved customer experiences. However, to fully realise these benefits, lenders must strategically plan their implementation, ensuring compliance with regulations, seamless data migration, and effective change management. By doing so, lenders can position themselves for success in the increasingly competitive and digital-first financial landscape.

Corestrat’s Digital Lending Automation (DLA) is a cloud-based lending automation platform that offers all the above-mentioned benefits and more for better lending practices. With DLA’s flexible API, lending organisations can easily integrate DLA into their existing systems and get started quickly with the automated lending process.