In today’s fast-paced financial landscape, technology plays a pivotal role in transforming the way businesses operate, especially in the fintech industry. Fintech, short for financial technology, has disrupted traditional financial institutions and given rise to innovative digital services. One crucial component of this transformation is decision management software. Best Decision Intelligence Software in India.

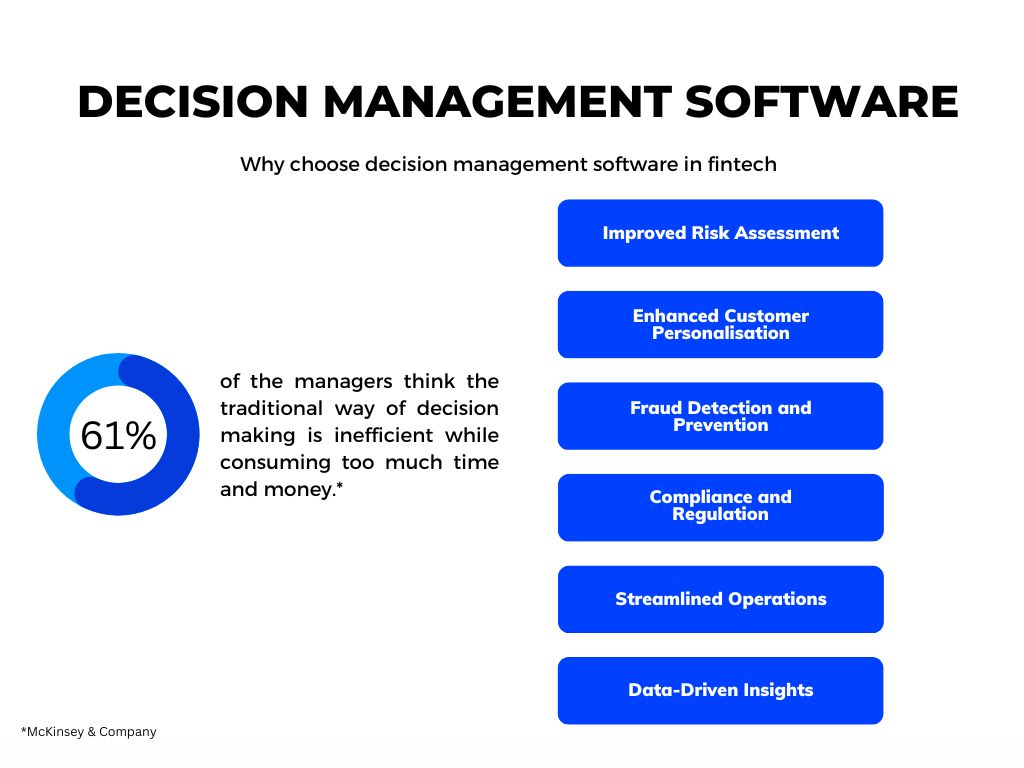

Fintechs rely heavily on data to make smarter decisions, gain a competitive edge, optimise their operations, and improve the accuracy and reliability of their services and solutions. According to research, 61% of managers believe that using traditional decision-making methods is inefficient, potentially resulting in a wastage of approximately 530,000 days of managerial time each year for a typical Fortune 500 company. This is equivalent to an annual wage expenditure of around $250 million.

This is where decision management software, driven by artificial intelligence and machine learning, takes the spotlight. It sifts through vast data volumes from various sources, including customer transactions, market data, and social media, to extract insights into customer behaviour, market trends, and risk factors.

This blog explores the role of decision management software in fintech and how it helps businesses make smarter, data-driven decisions.

What is decision management software?

Decision management software is a set of tools and processes designed to help organisations automate, streamline, and optimise their decision-making processes. It enables businesses to make more informed and data-driven decisions by utilising a combination of rules, logic, analytics, and data to evaluate and execute decisions across various operational and customer-facing applications. This type of software is particularly useful in industries and domains where complex and high-volume decisions need to be made rapidly and accurately.

The fintech industry is a data-rich environment, with vast amounts of information flowing through various channels. Decision management software enables fintech companies to harness this data to make real-time decisions, from loan approvals and fraud detection to personalised financial recommendations.

Why is Decision Management Software important for Fintechs?

With decision-makers in the fintech having to deal with a vast amount of data to make well-informed decisions, decision-makers need to have access to Decision Management Software. As this software consists of numerous other tools to assist in decision-making, decision management software, can save money, time and efforts of the decision-makers in making highly accurate decisions based on the data provided.

Here are the top 6 reasons explaining the role of decision management software in fintech:

Improved Risk Assessment

Fintech companies are often involved in lending and investment activities, which inherently come with risks. Decision management software helps in assessing and managing these risks effectively. By analysing historical data, market trends, and customer behaviour, it can provide risk scores and predictions, allowing decision-makers in fintech to make informed decisions on whether to approve a loan, invest in a particular asset, or extend credit to a customer.

Enhanced Customer Personalisation

Personalisation is a hallmark of the fintech industry, as customers seek tailored financial services and advice. Decision management software uses machine learning algorithms and customer profiling to deliver personalised product recommendations and offers. For instance, it can suggest investment options based on an individual’s credit risk or offer credit products suited to their financial situation.

Fraud Detection and Prevention

Fintech companies handle vast amounts of sensitive financial data, making them attractive targets for cybercriminals. Decision management software helps in real-time fraud detection and prevention by constantly monitoring transactions and customer behaviour patterns. When anomalies are detected, it can trigger automated responses, such as temporarily blocking a suspicious transaction and alerting the customer.

Compliance and Regulation

Compliance with financial regulations is a non-negotiable aspect of the fintech industry. Decision management software can assist in automating and ensuring compliance with complex regulatory requirements. It can flag potential compliance issues, generate necessary reports, and adapt to evolving regulations, reducing the risk of fines and penalties.

Streamlined Operations

In a fintech environment, efficiency is key. Decision management software streamlines internal processes by automating repetitive decision-making tasks. For example, it can automatically evaluate credit applications, reducing the need for manual review and expediting the approval process. This leads to cost savings and faster customer service, which are essential in the competitive fintech landscape.

Data-Driven Insights

One of the most valuable features of decision management software is its ability to generate insights from data. Fintech companies can use these insights to refine their business strategies, enhance customer experiences, and make informed decisions about product development. These insights can reveal customer preferences, market trends, and operational inefficiencies that might have otherwise gone unnoticed.

Conclusion

In the fintech industry, decision management software is a cornerstone of success. It empowers companies to leverage their data effectively, make informed decisions, manage risk, and create personalised customer experiences. As the fintech sector continues to grow and evolve, the role of decision management software will become even more crucial in ensuring innovation, compliance, and competitiveness. To stay ahead in this dynamic landscape, fintech companies must embrace these technological advancements, harness the power of data, and put decision management software to work.

Corestrat’s Decision Management Suite is a highly intelligent decision-management software, offering fintech companies the tools they need to analyze vast datasets and make strategic decisions for the improvement of their organizations. Decision-makers in fintech (or in the fintech sector) can place their trust in our software to unveil data patterns, effectively handle credit risks, and streamline lending processes.